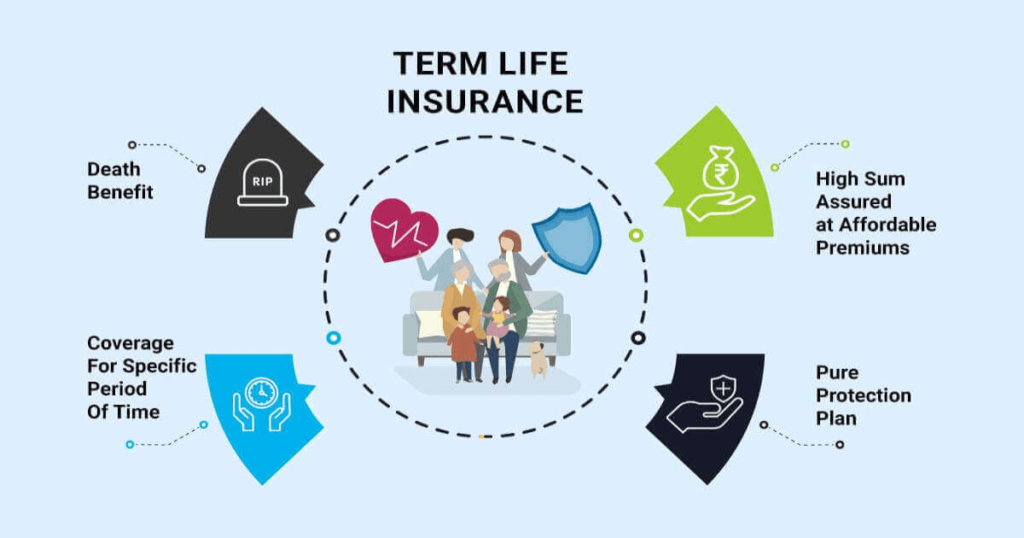

Term Life Insurance:

Term life insurance or Protections is a sort of life assurances that gives scope for a specific period or “term,” such as 10, 20, or 30 a long time. Here are a few key features:

Key Highlights of Term Life Insurance:

Scope Period: The course of action is energetic for a set term. If the policyholder passes missing in the midst of this period, the beneficiaries get the passing benefit.

Reasonableness: Term life securities is by and expansive more sensible than changeless life securities options, making it open for those requiring scope for a specific period, such as though raising children or paying off a mortgage.

No Cash Regard: Not at all like aggregate life assurances moreover term life securities does not develop cash regard. The course of action as it were pays out the passing advantage if the security net supplier passes on in the midst of the term.

Renewability: A few term life approaches offer the elective to energize at the conclusion of the term. In show disdain toward of the truth that more regularly than not at a higher premium. On the other hand, a few courses of action can be change over to aggregate life securities interior a specific time frame.

Who Should to Consider Term Life Insurance?

Term life assurances is culminate for individuals who require life assurances scope for a specific period. This consolidates people who:

Need to ensure their family is monetarily secure while their children are young.

Require to cover remarkable commitments, such as a contract, that will be pay off over time.

Look for sensible life assurances without the require for an theory or save reserves component.

Benefits

Lower Premiums: Since term life securities is completely for scope without an wander component, the premiums are routinely lower than those of aggregate life insurance.

Adaptability: You can select a term that matches your specific cash related responsibilities.

Drawbacks

No Esteem: There’s no cash regard conglomeration moreover meaning you cannot borrow against the approach or utilize it as an investment.

Close: If you outlive the term and the course of action isn’t renewable or convertible, the scope closes, and you won’t get any return on the premiums pay.

Related:

Health Insurance Policy In Nepal

Health Insurance In The United health group

More Stories

10 Best Benefits of Life Insurance of America:

What is an Endowment Insurance Plan?

Basics of Insurance, Understanding A Complete Guide