Types of SIPs:

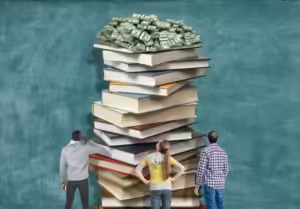

Systematic Venture Plans (Tastes) offer different types of SIPs to contribute in shared reserves, catering to diverse monetary objectives. Regular SIPs include settled ventures made at standard interims, giving teach in sparing. Top-up SIPs permit financial specialists to increment their commitments over time, adjusting with pay development or money related objectives. Perpetual SIPs empower nonstop ventures without a indicated conclusion date, advancing long-term riches aggregation. Finally, Flexible SIPs let speculators change their commitments based on monetary circumstances, permitting versatility. By understanding these Taste sorts, financial specialists can select the best methodology for their money related travel, adjusting hazard and development viably.

First Types Is Regular SIPs

Regular Efficient Speculation Plans (Tastes) are a well known speculation technique in common stores, permitting people to contribute a settled sum at customary intervals—usually month to month. This restrained approach makes a difference financial specialists construct riches over time without the stretch of showcase timing. Normal Tastes are perfect for long-term money related objectives, such as retirement or instruction, as they saddle the control of compounding. Moreover, they moderate showcase instability through rupee fetched averaging, where speculators purchase more units when costs are moo and less when costs are tall. This strategy advances consistency and can lead to significant riches aggregation over time.

Top-up SIPs

Top-up Precise Venture Plans (Tastes) offer financial specialists a adaptable way to upgrade their shared finance speculations. Not at all like standard Tastes, which require a settled speculation sum, top-up Tastes permit people to increment their commitment at foreordained interims. This include is especially advantageous for those encountering compensation climbs, rewards, or other monetary fortunes. By altering the speculation sum, financial specialists can way better adjust their commitments with their advancing monetary objectives, such as buying a domestic or subsidizing education.

Top-up Tastes moreover capitalize on the control of compounding. By expanding the venture, indeed unassumingly, speculators can essentially boost their potential returns over time. Moreover, this adaptability energizes restrained sparing propensities, making it simpler to develop riches in couple with one’s income.

Overall, top-up Tastes are an amazing choice for speculators looking to take advantage of their money related development whereas keeping up a efficient approach to contributing in shared reserves.

Perpetual SIPs

Perpetual Efficient Speculation Plans (Tastes) are a special speculation alternative in common stores, outlined for those committed to long-term riches creation. Not at all like conventional Tastes, which have a characterized residency, never-ending Tastes proceed inconclusively until the financial specialist chooses to halt them. This highlight is perfect for people pointing for progressing budgetary objectives, such as retirement or riches accumulation.

One of the fundamental points of interest of never-ending Tastes is their capacity to use the control of compounding over an expanded period. By reliably contributing a settled sum, speculators can take advantage of showcase changes, profiting from rupee taken a toll averaging. This decreases the affect of showcase instability, permitting for a smoother venture journey.

Additionally, interminable Tastes empower taught reserve funds, as they computerize the venture handle. With no conclusion date in locate, financial specialists can stay centered on their long-term monetary destinations, making them a vital choice for those looking to construct considerable riches over time.

Flexible SIPs

Flexible Efficient Speculation Plans (Tastes) give a energetic approach to contributing in shared reserves, permitting financial specialists to alter their commitments based on monetary circumstances. Not at all like conventional Tastes, which require settled sums at normal interims, adaptable Tastes let people increment or diminish their speculation concurring to their current budgetary circumstance. This versatility makes them perfect for those with variable livelihoods or changing expenses.

One of the key benefits of adaptable Tastes is the capacity to keep up speculation teach whereas pleasing life’s instabilities. Speculators can take advantage of advertise openings by expanding commitments amid favorable conditions or scaling back amid leaner times. This vital adaptability can upgrade long-term returns whereas overseeing risk.

Moreover, adaptable Tastes still advantage from the focal points of orderly contributing, such as rupee fetched averaging and compounding. By permitting for alterations, adaptable Tastes engage financial specialists to remain adjusted with their budgetary objectives, making them a keen choice for anybody looking for a custom fitted speculation strategy.

In conclusion, understanding the different types of SIPs—Regular, Top-up, Interminable, and Flexible—empowers speculators to tailor their techniques concurring to their monetary objectives and circumstances. Each sort offers one of a kind preferences, advancing taught contributing whereas obliging diverse life stages, eventually upgrading the potential for long-term riches aggregation.

Related:

Understanding SIP and Lump Sum Investments

Wealth Creation, How SIP Works and Its Benefits for Long-Term

1 thought on “Types of SIPs: Regular, Top-up, Perpetual And Flexible”